- Get link

- X

- Other Apps

Traditional retail financing with competitive buy rates. Ally Bank Auto Loan Special Features.

Ally Auto Loan Review 2020 New Used Car Loans Thru Dealer Network

Ally Auto Loan Review 2020 New Used Car Loans Thru Dealer Network

For new vehicles and used or certified pre-owned vehicles CPOV with up to 10 model years120000 miles at inception.

Ally auto rate. During this step you will choose the type of loan the loan amount put in your credit type or actual credit score and then your Zip Code. Monthly Car Payment Calculator. Estimate your monthly payments based on the amount you expect to finance the APR and term for which you think youd qualify.

Ally Bank the companys direct banking subsidiary offers an. ALLY is a leading digital financial services company. Ally Bank Auto Loan - Read unbiased reviews of Ally Bank Auto Loan rated 12 out of 5 stars by 187 users.

Refinance to a 4 interest rate and your monthly payment will drop to 368 saving you almost 2300 over the course of the term. An Ally Bank auto loan may be a good option for people who prefer to finance directly at the dealership while getting access to a variety of loan types. My son leased a car with them in May 2017.

Currently 29 of Allys retail customers and 70 of Allys commercial customers are in deferral programs. Keep in mind ACI Pay is a third party who may charge a money transfer fee for its payment services in addition to your payment amount. Heres what you can expect.

Near-prime credit and we observed an average auto loan interest rate of 12 within a range of - 6 while rates vary a lot by credit score. Annual Percentage Yield. Ally Bank the companys direct banking subsidiary offers an array of deposit personal lending and mortgage products and services.

Lets say you have a five-year 20000 auto financing package that charges an 8 interest rate. Youll need to have your Ally Auto account number your bank account number or card number and your ZIP code on hand. If you have the time and ability to shop around its best to compare interest rates at a variety of financial institutions.

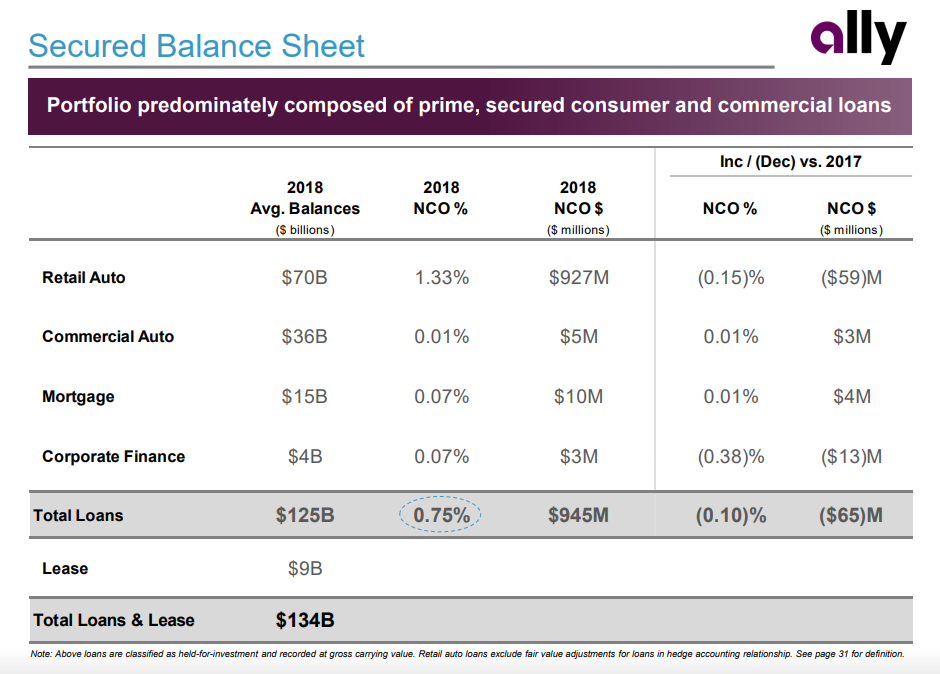

Ally Financial is by far the most incompetent and frustrating company I have ever dealt with and I am in my early 50s. What APR does Ally Auto Finance offer on its auto loans. Ally is modeling a 3 delinquency rate in 2020.

There are also several other high-quality auto refinance marketplaces besides Clearlane. We calculate your monthly payment based on the amount financed your APR the length of your contract and any extra payments. To research your options even further you could compare Allys rates with those from other lenders offering new and used auto loans.

Credit products and any applicable Mortgage credit and collateral are subject to approval and additional terms and. You can pay through ACI Pay by calling 1-888-631-8930. Ally Auto Finance offers a fixed APR auto loan product that ranges from 0 APR up to 18 APR.

Ally Bank is a Member FDIC and Equal Housing Lender NMLS ID 181005. Start with a great rate plus have the opportunity to increase your rate once over the 2-year term or twice over the 4-year term if our rate for your term and balance tier goes up. With Ally Balloon Advantage youll enjoy a fixed annual percentage rate or APR.

No minimum deposit required. Each month your car payment is around 406. Some of the lowest rates can be found at credit unions and membership might be easier than you think.

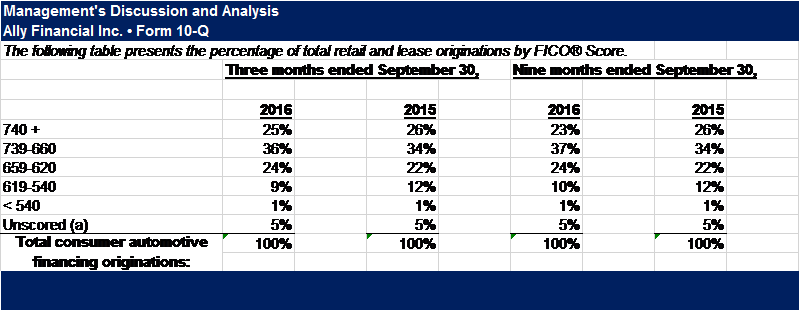

Products for prime and non-prime credit. Choices include lease loan and buy loan options. For a prime borrower FICO score between 661 to 780 a 16000 car loan with a repayment term of 36 months and an interest rate of.

Once you have an idea of what your starting interest rate might be you can now use the Ally Auto Calculator to help explore rates and payments. Youll have lower monthly payments during the term of your loan. Your APR can vary depending on several factors such as your credit score.

Early withdrawal penalty will apply. Financing for aftermarket products. Financial holding company offering financial products for consumers businesses automotive dealers and corporate clients.

Ally Financial targets the segment of American car shoppers with moderate ie. ALLY is a leading digital financial services company and a top 25 US. Ally auto loans come with a few special features that make them appealing options.

If youve got an existing auto loan and want better terms rateGenius. Standard rate options and supported rates for select original equipment manufacturer OEM programs.

Auto Financing Options How To Finance With Your Dealer And Ally Ally

Auto Financing Options How To Finance With Your Dealer And Ally Ally

Ally Bank Reviews Rates Fees Mybanktracker

Ally Bank Reviews Rates Fees Mybanktracker

Ally Auto Finance Vehicle Financing Vscs Tools Tips More

Ally Bank Review 2021 A Hassle Free Banking Option Investor Junkie

Ally Bank Review 2021 A Hassle Free Banking Option Investor Junkie

Ally Auto Loan Review 2020 New Used Car Loans Thru Dealer Network

Ally Auto Loan Review 2020 New Used Car Loans Thru Dealer Network

Ally Financial Rising Risk Profile Overexposure To Auto Industry And Rising Subprime Delinquencies Present Short Selling Opportunity Nyse Ally Seeking Alpha

Ally Financial Rising Risk Profile Overexposure To Auto Industry And Rising Subprime Delinquencies Present Short Selling Opportunity Nyse Ally Seeking Alpha

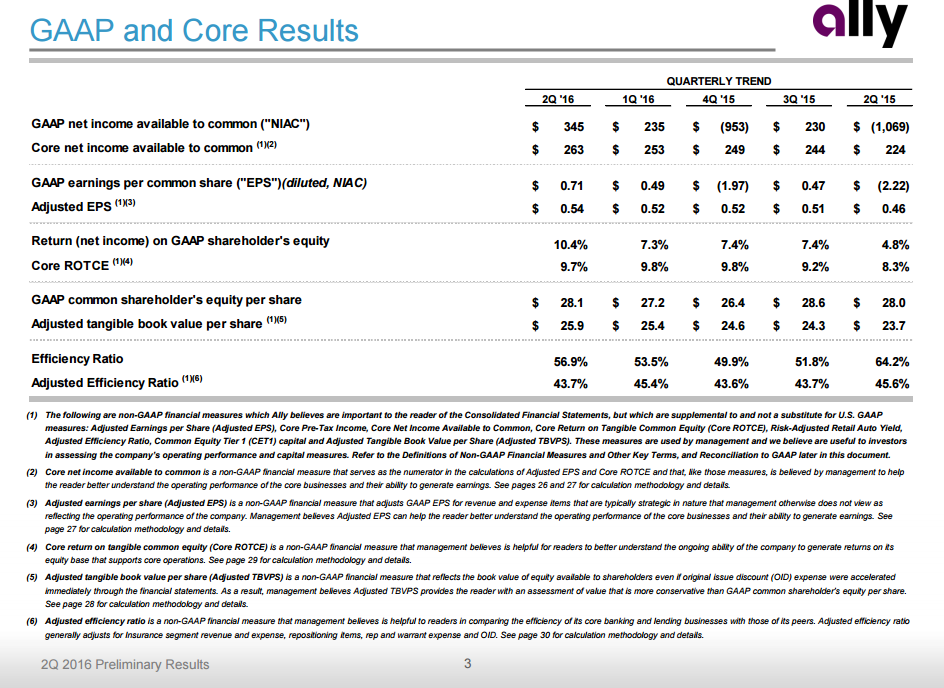

Ally Financial Clear Path To Double Digit Roe And Bvps Growth Nyse Ally Seeking Alpha

Ally Financial Clear Path To Double Digit Roe And Bvps Growth Nyse Ally Seeking Alpha

Ally Auto Loan Review 2020 New Used Car Loans Thru Dealer Network

Ally Auto Loan Review 2020 New Used Car Loans Thru Dealer Network

Ally Auto Loan Review 2020 New Used Car Loans Thru Dealer Network

Ally Auto Loan Review 2020 New Used Car Loans Thru Dealer Network

Ally Auto Loan Review 2020 New Used Car Loans Thru Dealer Network

Ally Auto Loan Review 2020 New Used Car Loans Thru Dealer Network

Ally Bank Auto Loan Reviews For 2021

Ally Bank Auto Loan Reviews For 2021

Manage Your Auto Account Make A Vehicle Payment Ally

Manage Your Auto Account Make A Vehicle Payment Ally

Unloved Ally Financial Is A Strong Buy Nyse Ally Seeking Alpha

Unloved Ally Financial Is A Strong Buy Nyse Ally Seeking Alpha

Ally Auto Finance Vehicle Financing Vscs Tools Tips More

Comments

Post a Comment